Why Goldman’s $3100 gold price target is low

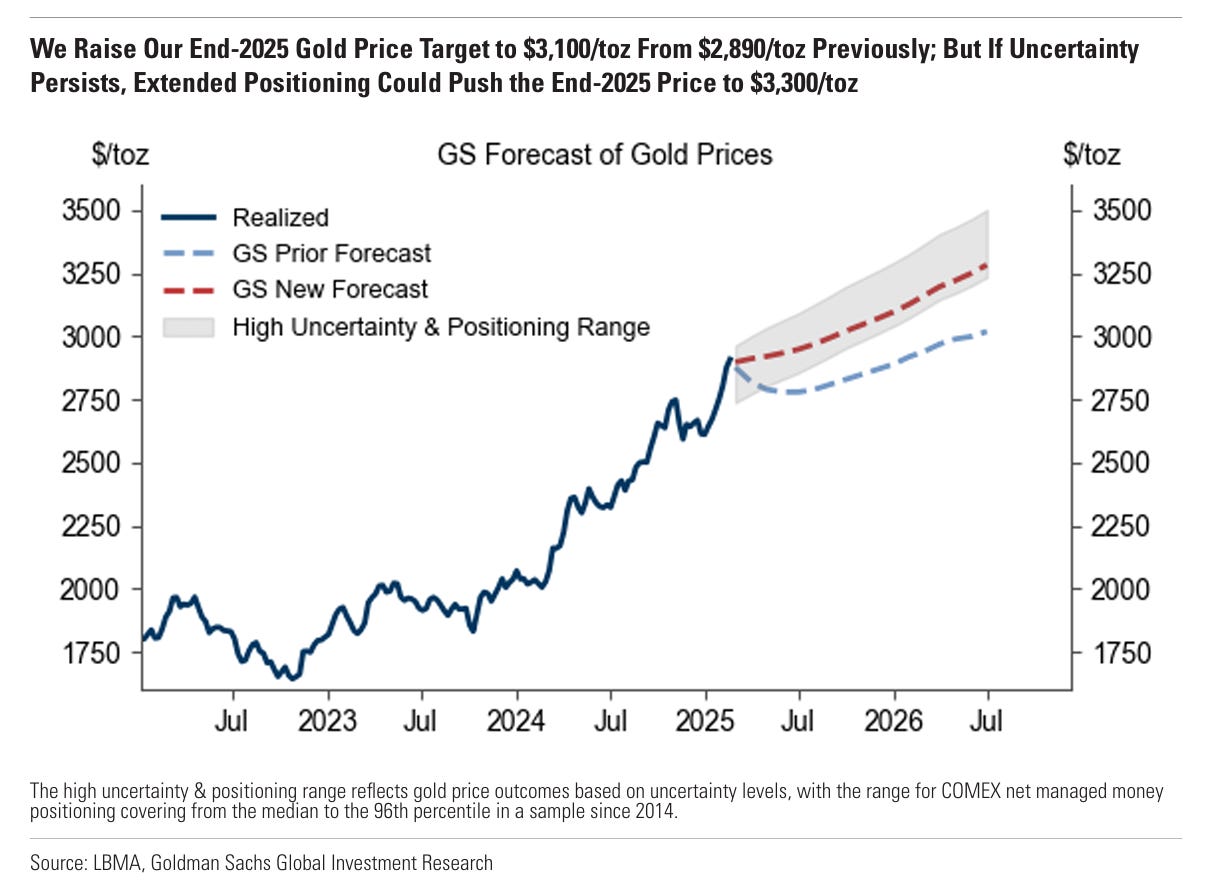

Goldman Sachs raised its 2025 gold forecast to $3,100/oz, up from $2,890, citing expectations of sustained central bank demand and market dynamics.

Before we drill down on this report, some context is in order, namely a bigger picture overview of the London Gold drainage situation, a signpost of why we feel Goldman’s target is low.

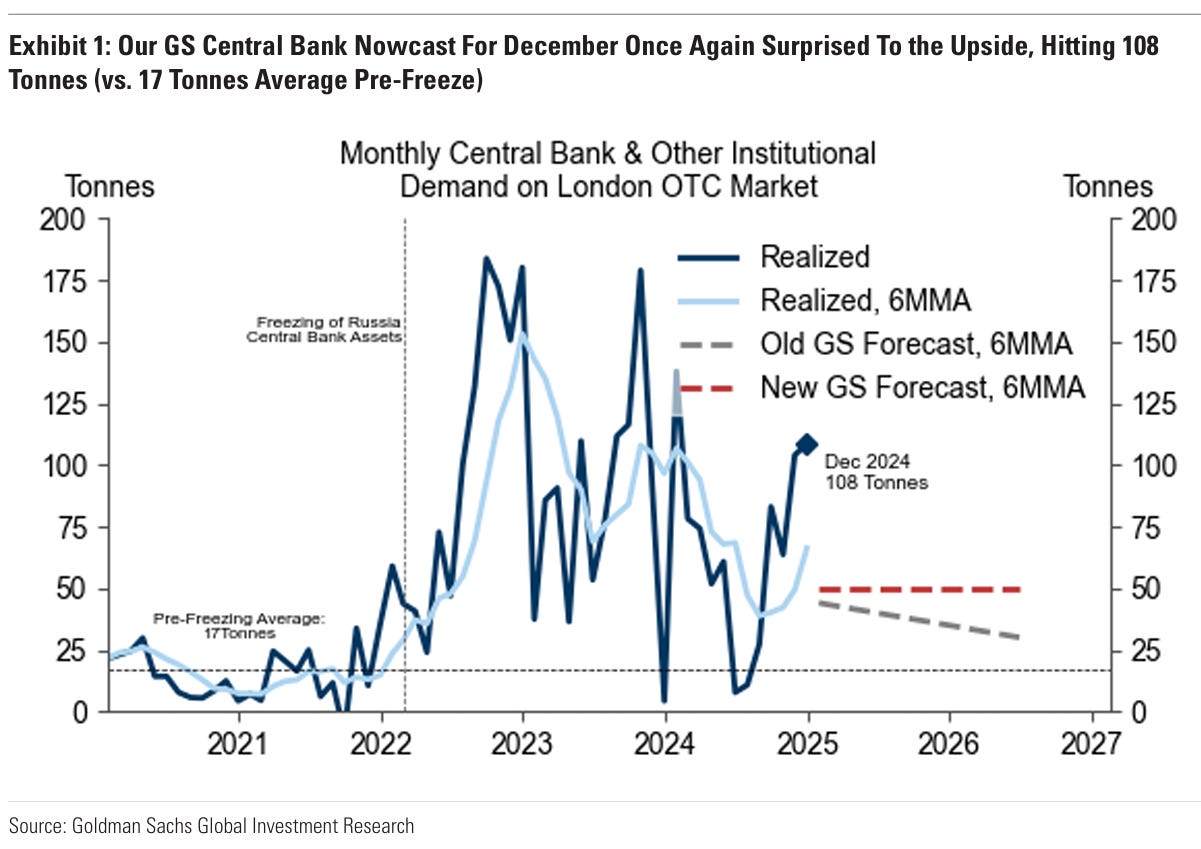

Central Bank Demand Rises Again

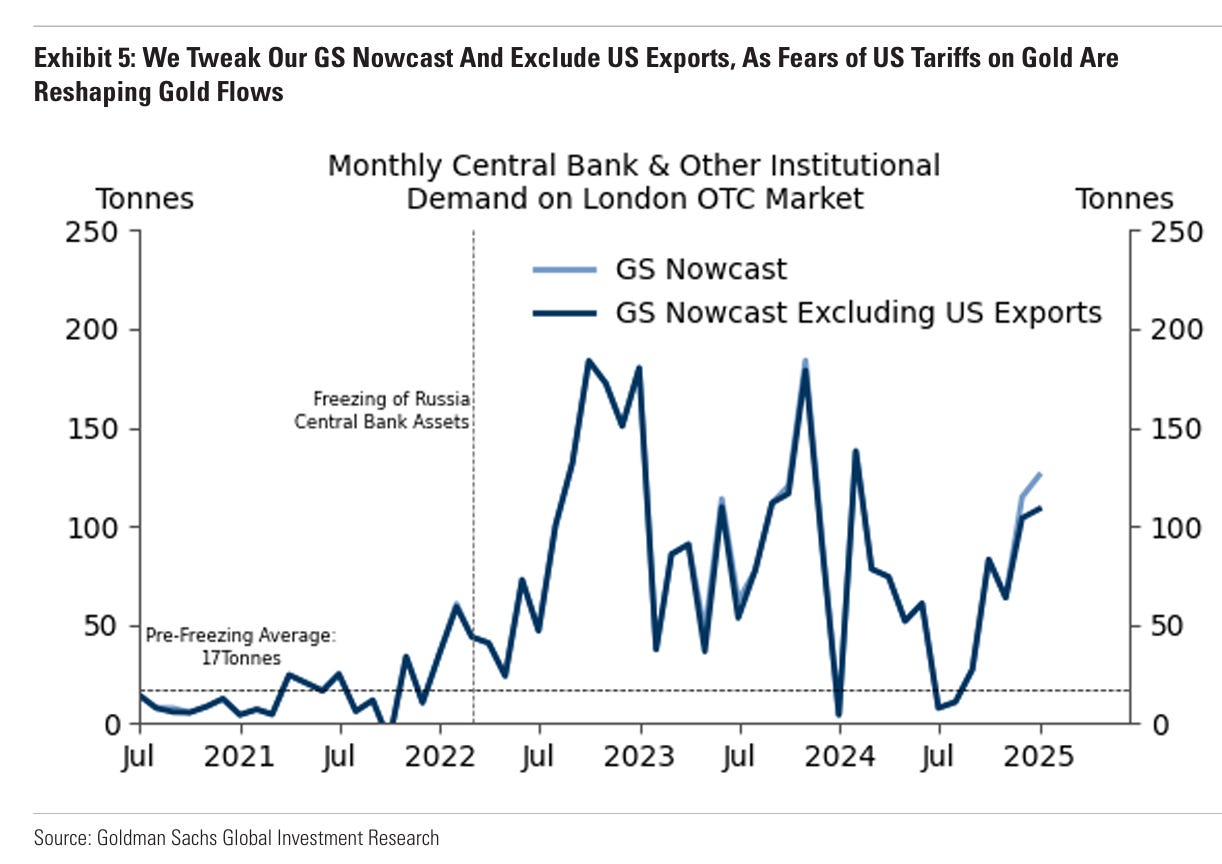

Goldman estimates that a "structural rise in central bank demand would add 9% to gold prices by the end of 2025." The bank increased its central bank demand assumption to 50 tonnes per month, up from 41 tonnes. Should monthly purchases average 70 tonnes, Goldman sees gold reaching $3,300 per ounce by year-end 2025.“The December reading of our GS nowcast of central bank and other institutional gold demand on the London OTC market came in strong at 108 tonnes… China was again the largest buyer, adding 45 tonnes.” – Goldman Sachs.As a result, Goldman raised its baseline assumption for central bank buying to 50 tonnes per month (from 41 tonnes). This sustained demand is expected to add 9% to gold prices by the end of 2025.

We would add, the change from 41 to 50 tonnes is even more significant when you consider the bank changed a 6 month moving average after 2 months of data— not a one month data point— by over 20%.

Bank of America expects that [China’s insurance] companies will purchase gold actively and use their allowance within a year. Putting concrete numbers behind this, the purchases could generate around 300 tonnes of gold purchases.If you are old enough to remember, this is very similar to what Ronald Reagan did in the 1980s when he deregulated insurance companies enabling them to invest in and offer more stock-based insurance products. This was one harbinger of the great 1980s bull market.

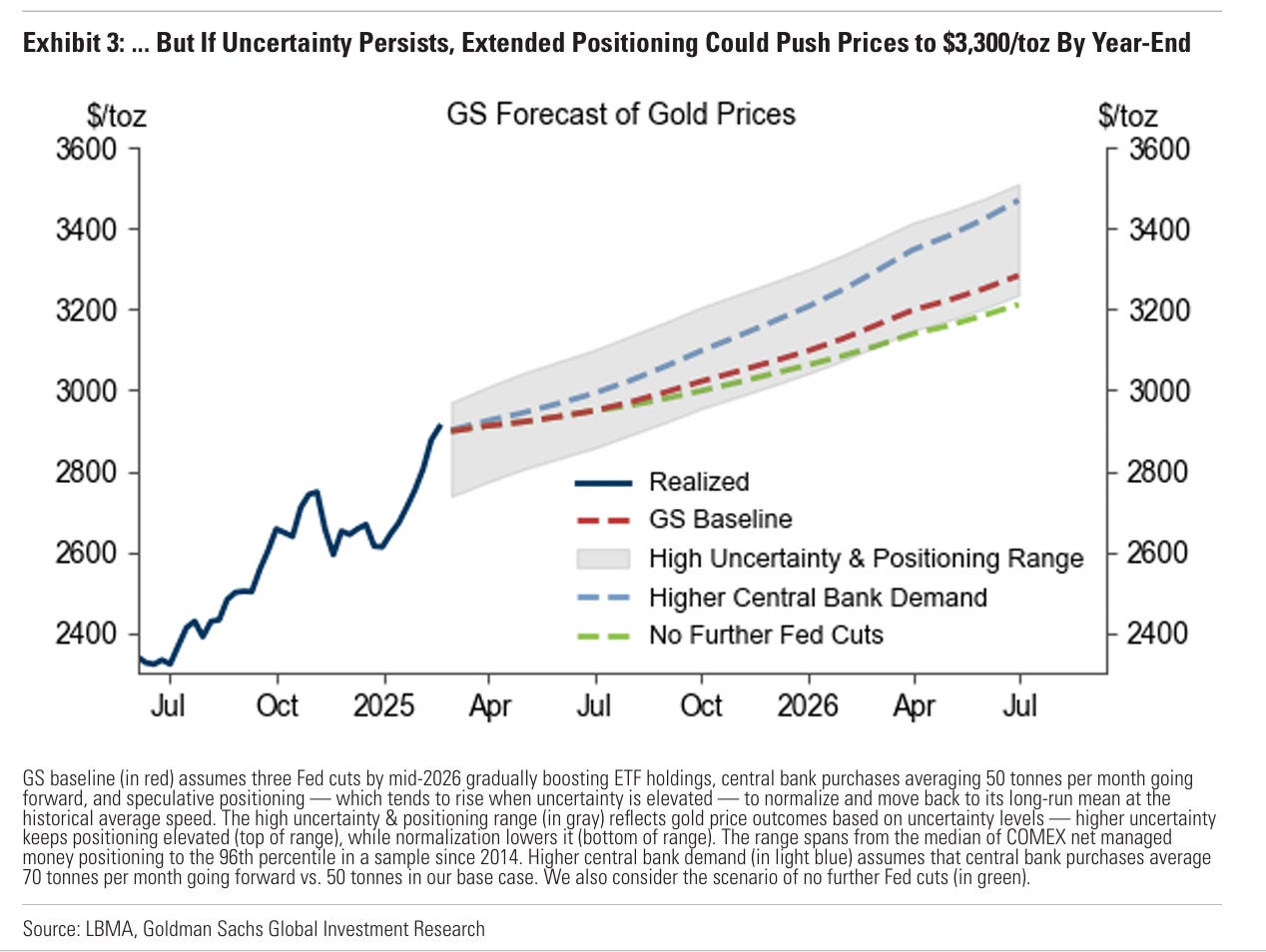

Taken together, the probability of Goldman’s $3300 target, and even BOA’s $3,500 target are not insignificant. Goldman also notes significant upside risks not yet in their price calculus. We make it clear that one of them, the Tariff risk, is already manifesting and will not stop.

More Upside Surprise Risks

Goldman outlined multiple scenarios for gold's trajectory:- If the Fed does not cut for the rest of 2025, even with no further increases in China buying, gold is forecasted to hit $3,060 per ounce.- green line

The Kicker: Tariffs are Outrageously Bullish Gold

To put a fine point on it: Policy uncertainty is already intensifying. Gold is a hedge against uncertainty, as most know. But what happens when that uncertainty actually resolves negatively? The graphic below says what happens. More Gold is bought, and less Gold is exported freely.“We Tweak Our GS Nowcast (OTC London Bullion monitor) and Exclude US Exports, As Fears of Tariffs on Gold Are Reshaping Gold Flows”- Goldman SachsIf the US puts tariffs on Gold, it must also cease exporting it’s own gold. It must protect what gold it has since the US have effectively cut off its own suppliers

Here’s The kicker. Tariffs are bullish for Gold even if they do not apply to Gold itself.

Why? Any nation tariffed by the USA—even without Gold and Silver tariffed—is one step closer to having that nation’s sovereign wealth confiscated by the US as was done to Russia in 2022. As a nation’s fear of eventual confiscation escalates, so does its desire to get out of held dollars and treasuries (euphemistically called “dollar-diversification”) and replace those with something that cannot be confiscated: Gold and Silver in hand. Specifically for Sovereign enttities:

The risk of confiscation starting with tariffs in a post 2022 Russian-Sanction world is very clear. You cannot own just dollars.

- IF: Tariffs >> Sanctions >> Confiscation Risk

- THEN: Sell Treasuries >> Buy Gold and Silver

Goldman’s Target is Low

Goldman reiterated its "buy gold" trading stance. The bank emphasized gold’s value as a hedge against risks such as trade tensions, potential Fed policy missteps, and recession threats, noting these could push gold toward the upper end of its uncertainty range.Given that Goldman’s analysis does not factor in the the Chinese insurance industry’s incipient physical off take, we think Goldman is holding back on their bullishness. The higher upside is all but certain if China’s insurance industry buys in.

About: Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

"Best Overall" by Money Magazine, Award-Winning for 6 Years, Thousands of 5-Star RankingsExpand Details

Renowned for its exceptional customer service and commitment to transparency, Augusta Precious Metals has garnered numerous accolades, including "Best Overall" from Money magazine and "Most Transparent" from Investopedia. The company's dedication to educating and supporting its clients has earned it top ratings from organizations such as A+ from BBB and AAA from BCA.

Industry leader with over $2 Billion in gold and silver. Top rated precious metals company with buy back guaranteeExpand Details

From precious metals iras to direct purchases of gold and silver, goldco have helped thousands of americans place over $2 billion in gold and silver. Top-rated precious metals company rated A+ by the better business bureau rated triple a by business consumer alliance earned over 6,000+ 5-star customer ratings Money.Com 2024 best customer service 2024 inc. 5000 regionals: pacific ranked #17 2024 gold stevie award, fastest growing company inc. 5000 award recipient, 8+ years

American Hartford Gold, ranked #1 Gold Company on Inc. 5000, boasts thousands of A+ BBB ratings and 5-star reviews, endorsed by Bill O'Reilly and Rick Harrison..Expand Details

With over $2 billion in precious metals sold, American Hartford Gold helps individuals and families diversify and protect their wealth. Their expert team provides investors with the latest market insights and a historical perspective, ensuring informed decisions. Trusted by public figures and praised for exceptional customer service, the company offers competitive pricing on top-tier gold and silver coins, backed by a 100% customer satisfaction guarantee