Why It's Silver's Time to Shine Now

Discover why silver's long period of stagnation is about to end.

Gold has been soaring all year, while silver has spent the past nine months languishing, leaving long-suffering investors wondering: Will silver always play second fiddle to gold, or is it finally ready to shine? Like many, I’ve been frustrated by silver’s lackluster performance, but in this report, I’ll highlight a growing number of reasons to believe its rough patch may soon be over. Silver may finally step out of gold’s shadow and embark on a sustained bull market of its own.

The first key sign that silver is ready to surge is its decisive move above the $32 to $33 resistance zone, which has acted as a stubborn ceiling for much of the past year. This breakout is an encouraging signal, but the next crucial confirmation will be a strong, high-volume close above the $34 to $35 resistance zone—the same level that halted the late-October rally in its tracks. Once silver clears both barriers, the path should be wide open for the powerful bull market I’ve anticipated since April 2024. However, for this breakout to remain valid, silver must close and hold above both resistance zones; otherwise, all bets are off.

Recently, silver broke above the €30 level—a bullish signal—establishing it as a new support. Next, a decisive close above €32 (the late October high) is necessary to signal that the next phase of the bull market has begun. That said, for the breakout to remain valid, silver must close and hold above both resistance zones; otherwise, I would consider it invalidated.

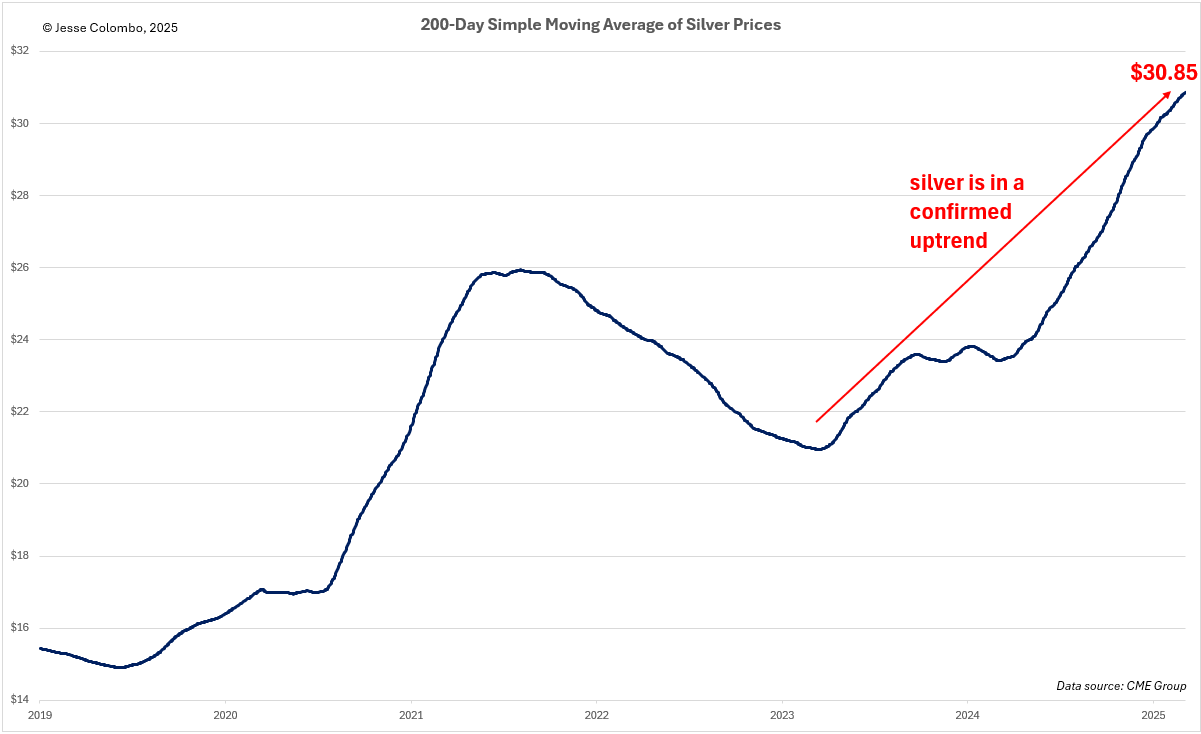

More importantly, the 200-day moving average suggests that the odds favor further gains, as a trend in motion tends to stay in motion—much like Newton’s first law of motion, also known as the law of inertia. The even better news is that once silver fully breaks out, as discussed earlier, I expect it to rise in a much more orderly fashion rather than continuing its erratic price swings.

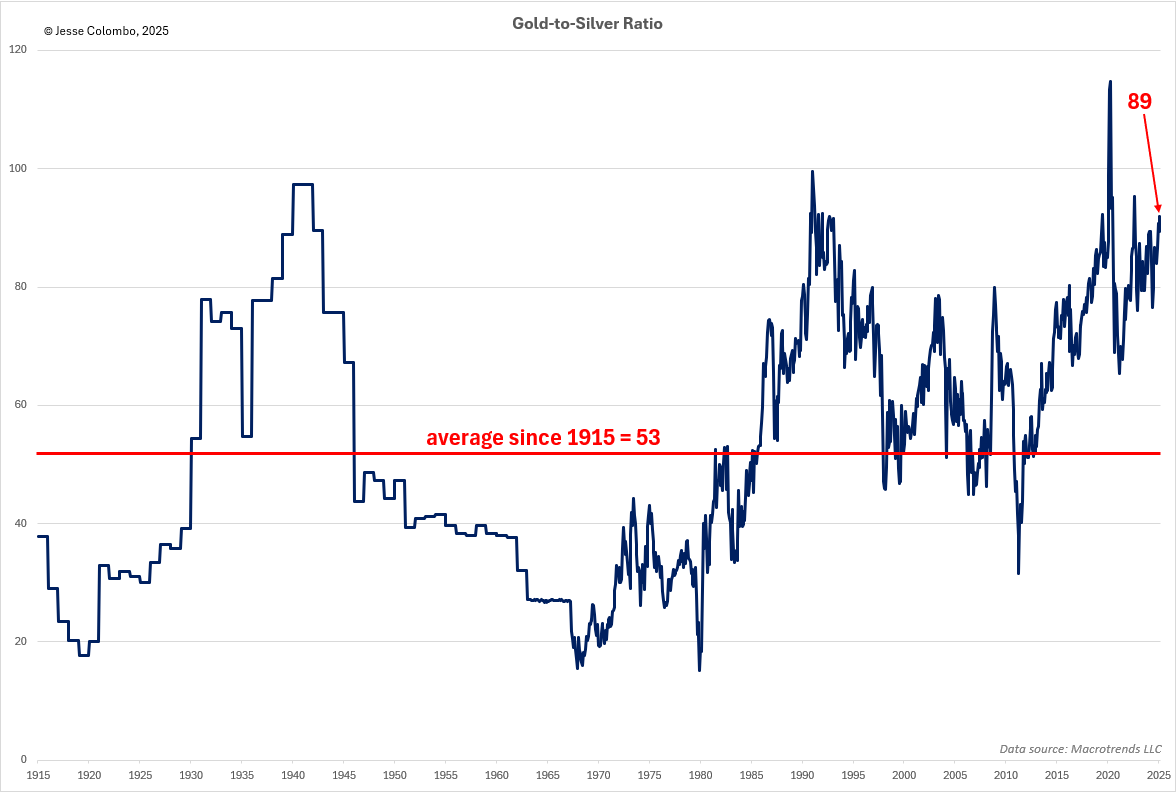

Based on historical patterns, gold could climb to roughly $3,380 in this leg of the rally alone, which would provide a strong catalyst for silver. As I’ll explain shortly, the higher gold climbs, the more undervalued silver will become relative to gold, making it increasingly difficult for silver to remain at these relatively low levels while gold continues to soar.

Also, take a look at the chart below and notice how gold struggled from 2020 to early 2024 to break above the $2,000–$2,100 resistance zone, which acted as a price ceiling for much of that period. Despite multiple attempts, gold was repeatedly pushed back down. However, in March 2024, it finally broke out, igniting the powerful bull market we see today. I see striking parallels with silver’s $32–$33 resistance zone over the past year and believe that once silver manages to close above this level, it will soar just as gold did.

For several months, I’ve been closely watching the SSPI as it struggled to break above the critical 2,600 to 2,640 resistance zone, repeatedly emphasizing that a breakout above this level would be a strong bullish confirmation for silver. Thanks to recent impressive rallies in both copper and gold, that long-anticipated breakout has finally occurred, signaling that a significant move in silver is likely imminent. However, for this breakout to remain valid, the SSPI must stay above the 2,600 to 2,640 zone, which has now turned into a key support level. If it holds, it will further strengthen the case for a powerful silver rally ahead.

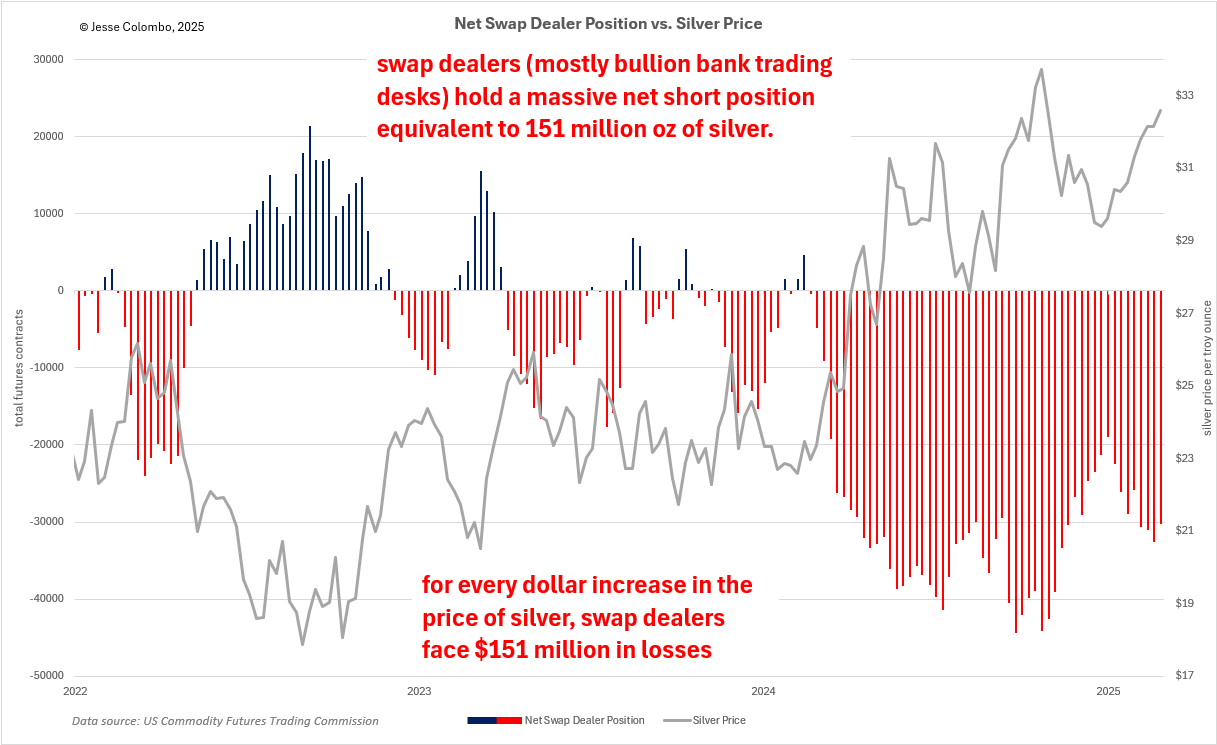

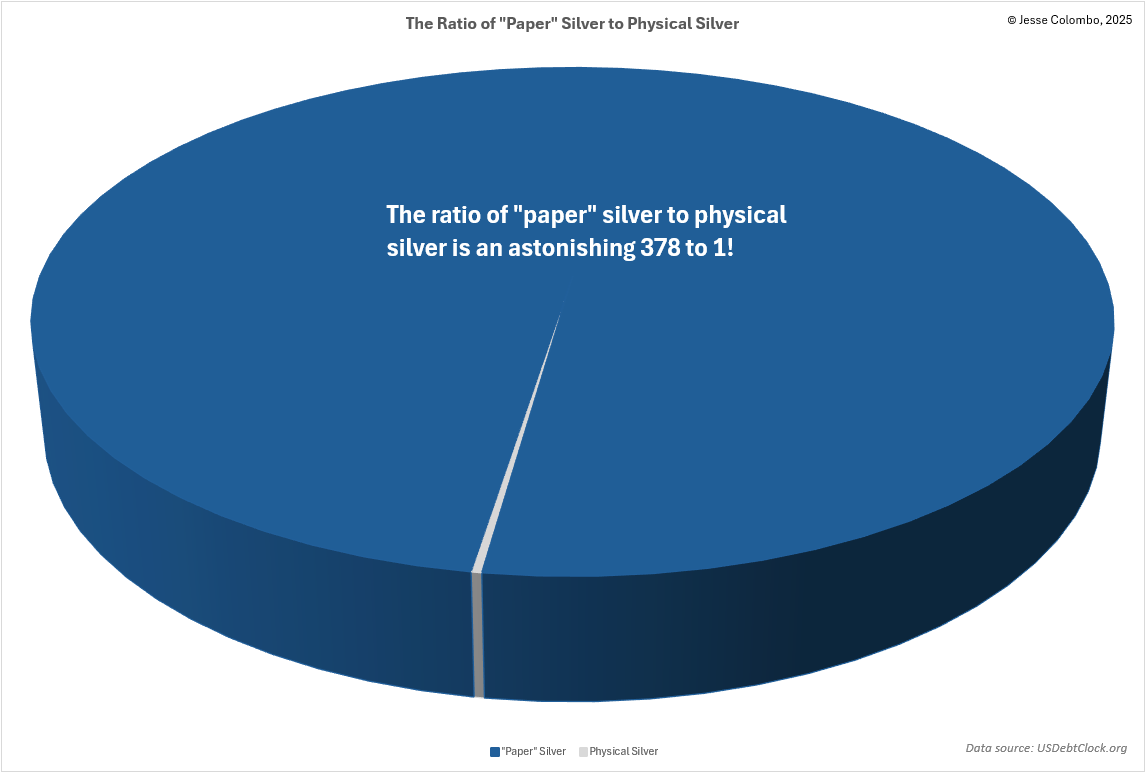

What’s even more astonishing is how much of this massive short position in silver futures is naked, meaning it isn’t backed by physical silver. It’s merely “paper” silver being dumped onto the market to suppress prices. However, once silver finally breaks out, it could trigger a wave of short-covering—when traders who bet against an asset through short-selling are forced to buy it back as prices rise to limit their losses. As the price climbs, these traders become increasingly desperate to close their positions, further fueling the rally.

If the buying pressure is intense enough, it could even lead to a short squeeze, dramatically amplifying silver’s upward momentum. Given the sheer size of their short position, bullion banks stand to lose approximately $151 million for every $1 increase in the price of silver—a setup for a major price surge. Now, just imagine what will happen as silver climbs by $5, $10, $20, and beyond from this point.

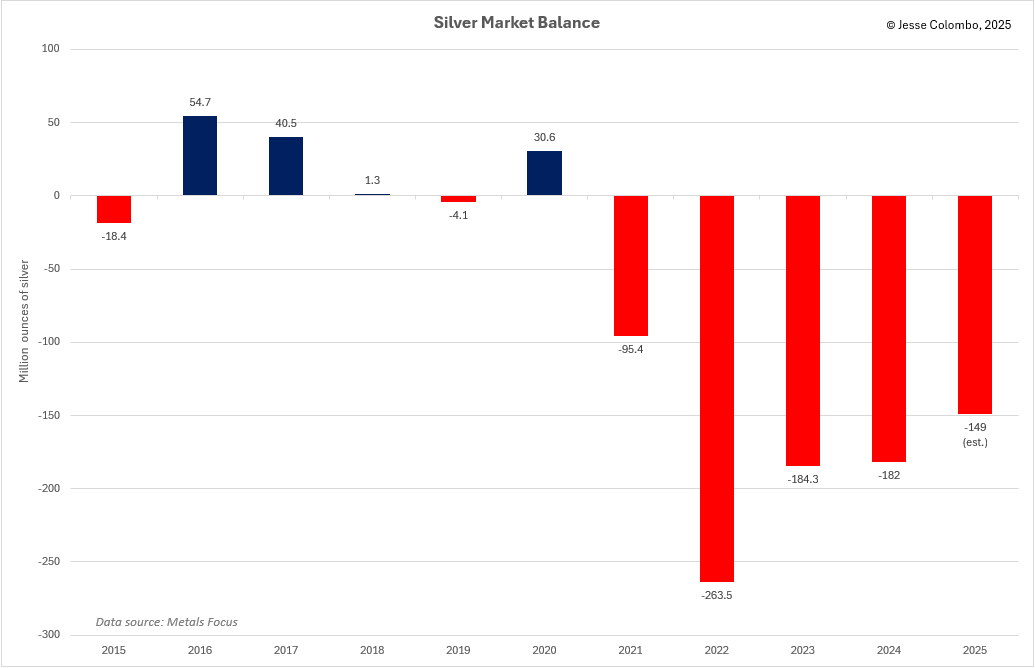

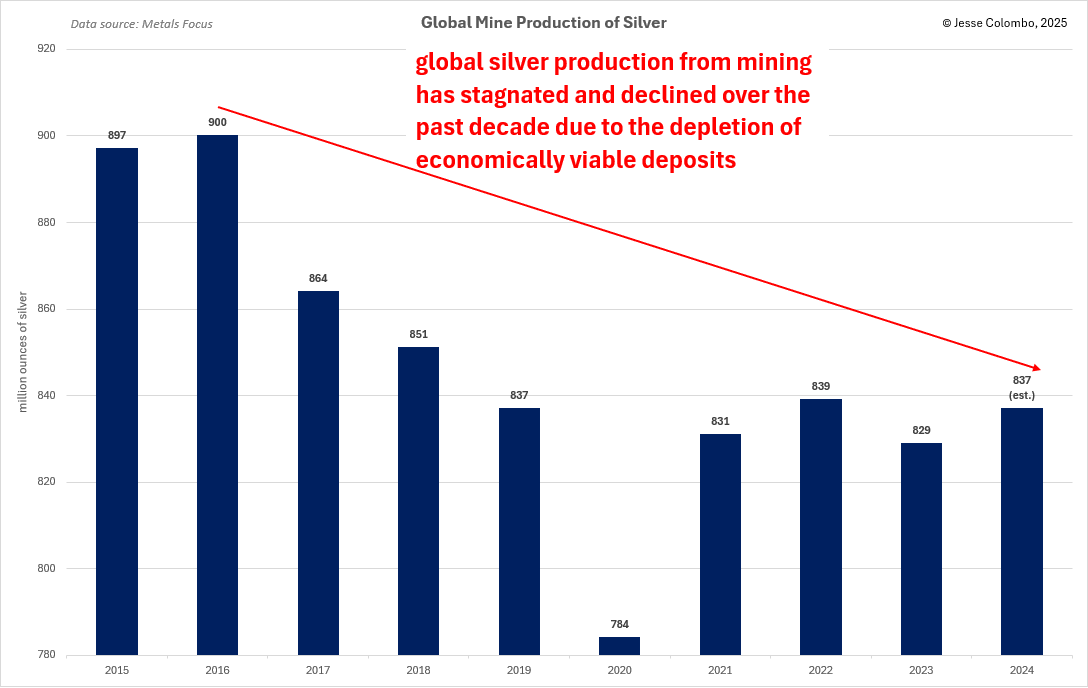

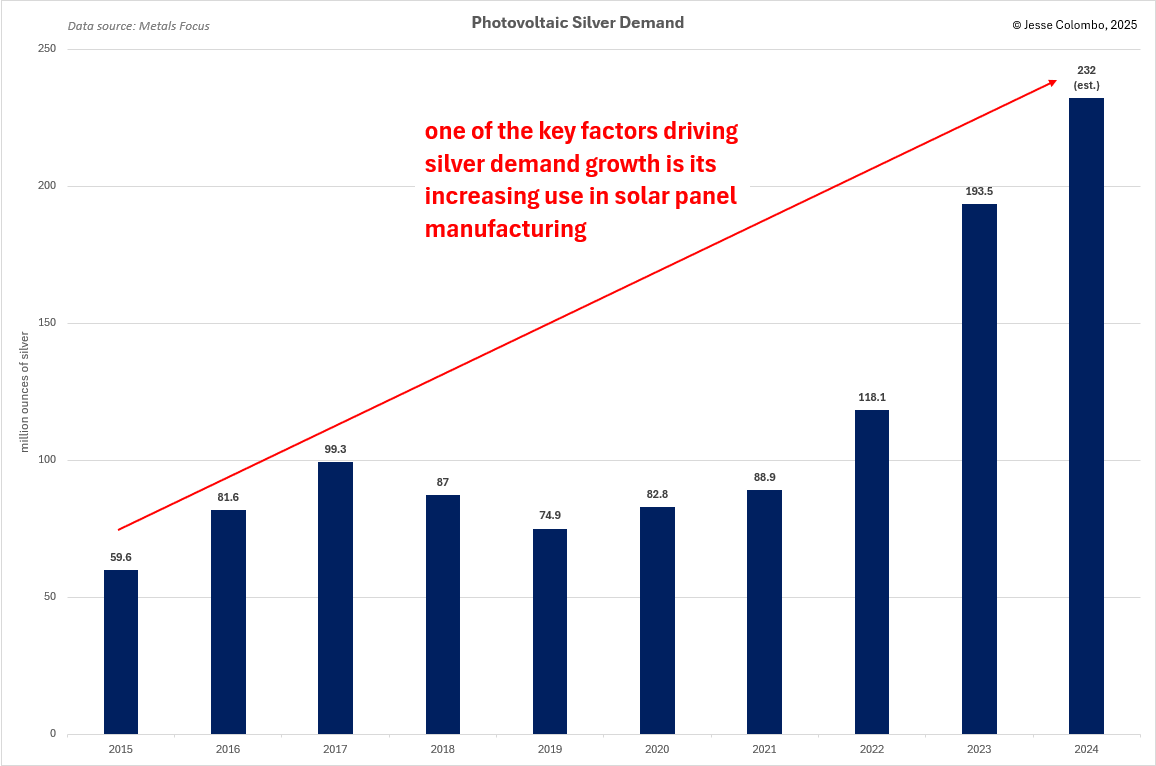

On the supply side, global silver mine production has peaked and declined over the past decade as economically viable deposits become depleted—something the bullion banks have absolutely no control over. And as time goes on, this supply crunch is only likely to worsen.

All investments carry risk, and past performance is not indicative of future results. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher disclaim any liability for financial losses or damages incurred as a result of reliance on the information provided.

Subscribe to Jesse Substack for more content like this - https://thebubblebubble.substack.com/

Don't miss out on the opportunity to invest in Gold & Silver. Check out our featured companies today: (Ad)

"Best Overall" by Money Magazine, Award-Winning for 6 Years, Thousands of 5-Star RankingsExpand Details

Renowned for its exceptional customer service and commitment to transparency, Augusta Precious Metals has garnered numerous accolades, including "Best Overall" from Money magazine and "Most Transparent" from Investopedia. The company's dedication to educating and supporting its clients has earned it top ratings from organizations such as A+ from BBB and AAA from BCA.

Industry leader with over $2 Billion in gold and silver. Top rated precious metals company with buy back guaranteeExpand Details

From precious metals iras to direct purchases of gold and silver, goldco have helped thousands of americans place over $2 billion in gold and silver. Top-rated precious metals company rated A+ by the better business bureau rated triple a by business consumer alliance earned over 6,000+ 5-star customer ratings Money.Com 2024 best customer service 2024 inc. 5000 regionals: pacific ranked #17 2024 gold stevie award, fastest growing company inc. 5000 award recipient, 8+ years

American Hartford Gold, ranked #1 Gold Company on Inc. 5000, boasts thousands of A+ BBB ratings and 5-star reviews, endorsed by Bill O'Reilly and Rick Harrison..Expand Details

With over $2 billion in precious metals sold, American Hartford Gold helps individuals and families diversify and protect their wealth. Their expert team provides investors with the latest market insights and a historical perspective, ensuring informed decisions. Trusted by public figures and praised for exceptional customer service, the company offers competitive pricing on top-tier gold and silver coins, backed by a 100% customer satisfaction guarantee