Tariff Day Aftermath: Unpacking the Market Carnage

A look at where major assets—from precious metals to stocks—stand after today’s sharp downturn.

Today was an ugly day in the markets, with losses sweeping across nearly every asset and sector. A staggering $2.5 trillion was wiped out from stocks alone, marking the worst market day since June 2020. While equities have been steadily sliding over the past couple of months—and I warned just days ago that things looked poised to get worse—today’s dramatic selloff was fueled by the Trump administration’s unexpectedly aggressive and far-reaching tariff announcement on Wednesday afternoon. The move has significantly raised fears of a full-blown global trade war.

The S&P 500 sunk 4.89%, the tech-heavy Nasdaq 100 plunged 5.48%, and the Dow Jones Industrial Average (DJIA) tumbled 1,716 points, or 4.04%. Meanwhile, the small-cap Russell 2000 sank 6.57%, making it the first major U.S. index to officially enter a bear market. And it wasn’t just stocks—commodities were hit hard too: gold dropped 1.41%, silver fell 5.99%, oil lost 6.64%, and copper slid 4.21%, just to name a few. Simply put, it was a mass liquidation event—everything but the kitchen sink got dumped.

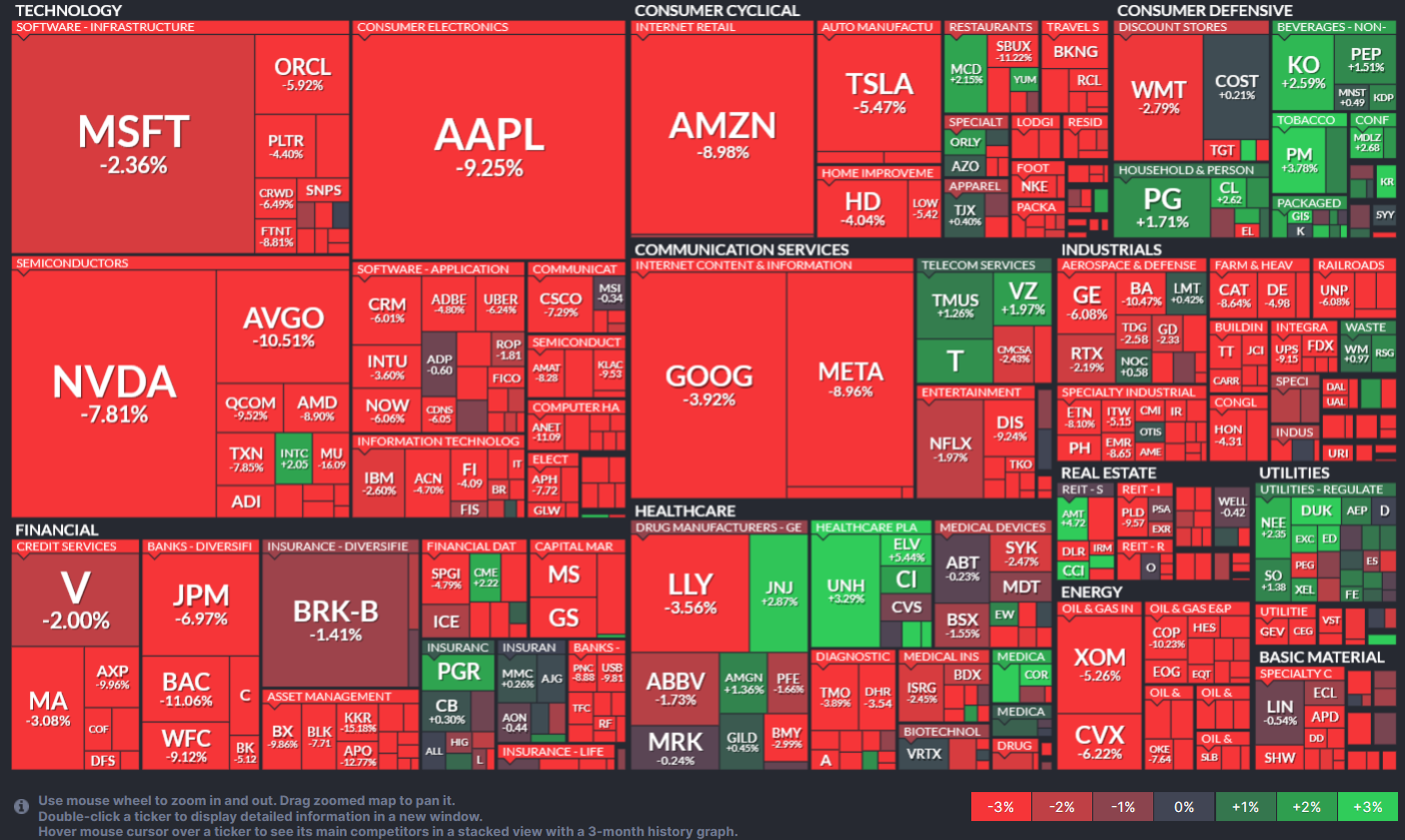

As you can see from the S&P 500 heatmap below, virtually no stock market sector was spared, with the technology and financial sectors taking the hardest hits:

Precious metals are liquidity-sensitive assets and often decline during sharp market selloffs, a pattern that goes back as far as I can remember. This happens because investors facing margin calls or needing to raise cash often sell even safe havens like gold and silver to meet those obligations. Some newer investors mistakenly believe gold and silver are perfect inverse hedges to equities, which can lead to unrealistic expectations. But I am not worried at all, as I’ll explain below.

First off, let’s take a look at gold. I was actually quite pleasantly surprised by how well it held up during today’s broad-based liquidation. While gold initially sank in the morning—dropping as low as $3,073 on COMEX futures—it staged an impressive rebound, closing down just 1.41% at $3,121. That’s a win in my book and a definite sign of underlying strength and demand that continues to buy every dip.

I pay close attention to $100 increments in gold futures, as they often act as key support and resistance zones. Today’s dip below $3,100 was short-lived, and the bounce back above that level by the close is encouraging. Ideally, I’d like to see that $3,100 level continue to hold going forward.

At this point, gold still looks solid to me, and I’m glad it remains the bedrock of my portfolio. I’m also very bullish on silver and mining stocks—I love them and look to them for serious upside—but their well-known volatility is why I avoid putting the bulk of my capital into them.

Still, I’m calling foul on today’s drop in silver—it was excessive and, in my view, completely unjustified. I place the blame squarely on the bullion banks, who dumped massive amounts of silver in an obvious effort to suppress the price, as I outlined in detail in my recent report and video presentation.

Bullion banks have a long history of using major events as cover to dump paper silver—whether it’s key economic data releases, presidential elections, or, in this case, the tariff announcement. I liken this tactic to one famously used by Vasily Zaitsev, the legendary Soviet sniper from World War II, whose story was depicted in the 2001 film Enemy at the Gates.

Zaitsev would time his shots with artillery or bomb blasts, masking the sound of his rifle to avoid detection (watch a clip of this from the movie). In essence, the bullion banks do the same: they wait for market "explosions," then strike—dumping large volumes of paper silver under the cover of chaos, and blaming the price drop on the event itself. It’s a frustratingly familiar playbook—and yes, it’s infuriating.

From a technical standpoint, it hurts to see that big red candle on silver’s chart, especially after such a strong recent run. The bullion bank ambush knocked silver just below the key $32–$33 zone—exactly where they’ve been aiming, as that area has served as a major battleground over the past year.

Still, the broader trend remains up, and this selloff was clearly overdone. I think there’s a strong chance silver bounces from here and begins to recover. It's also holding just above its uptrend line that dates back to February 2024—a solid support level that should serve as a launchpad for the next move higher.

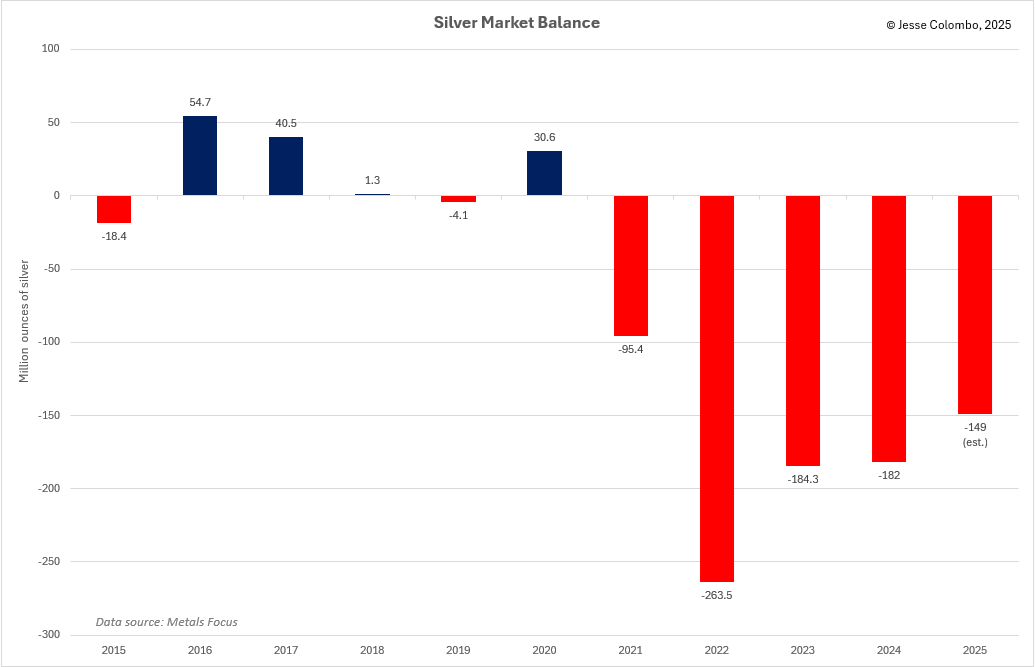

That’s the real story—the actual economics of silver, where the rubber meets the road—not the paper shenanigans we see in the futures markets. If you own physical silver, you’re holding a commodity that’s becoming increasingly scarce and more valuable by the day.

For those who still doubt whether silver is manipulated or suppressed, the ongoing deficit is itself evidence of that suppression. In a truly free market, a sustained supply deficit would naturally drive prices higher, incentivizing increased production and eventually bringing more supply to market. But because silver prices have been held artificially low, miners lack the financial incentive to ramp up output—resulting in a market that’s remained chronically undersupplied for an astonishing five years.

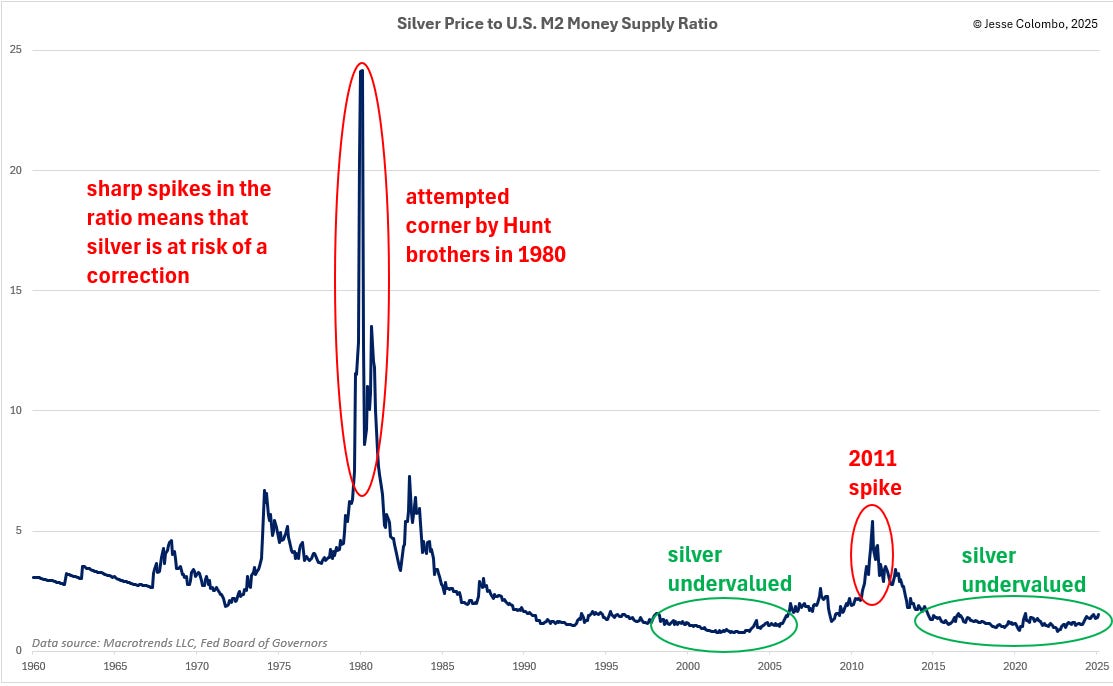

As the chart below illustrates, it hasn’t—and that disconnect implies that silver is significantly undervalued at current levels. This is yet another reason I’m not concerned about holding silver, regardless of the games the bullion banks may play. I simply don’t see it falling much further from here.

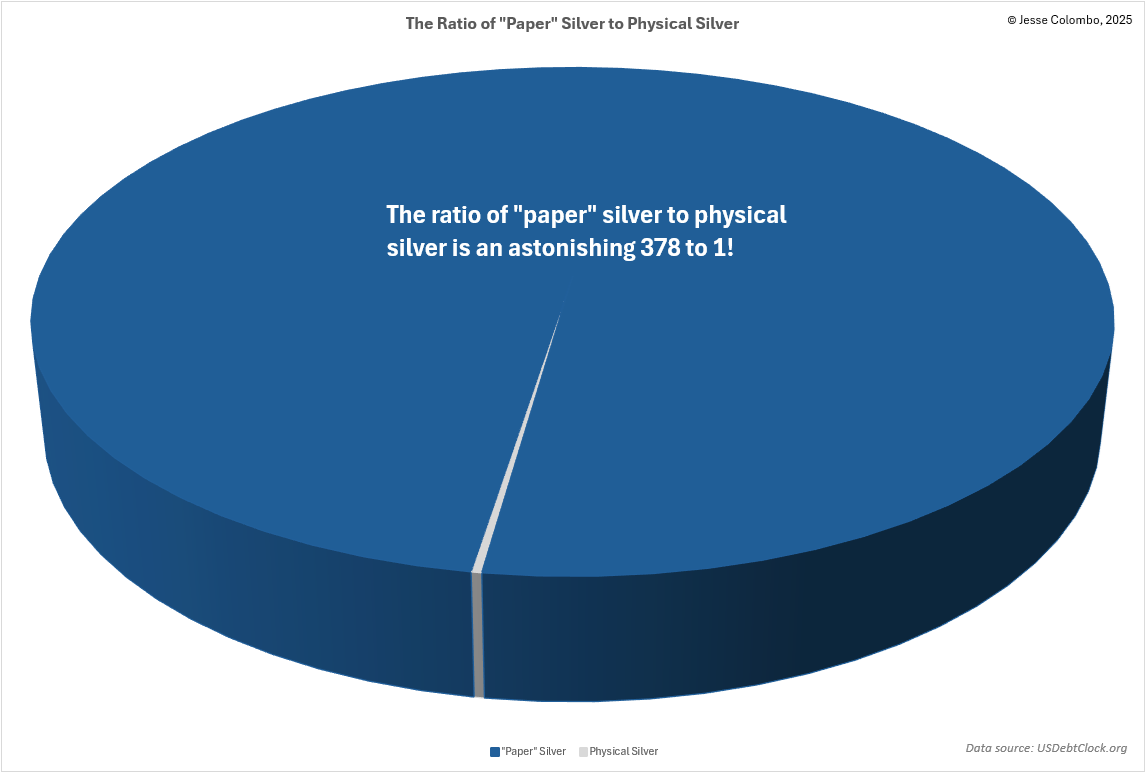

But here’s the key—they can’t conjure real, physical silver. That’s why owning physical silver bullion in your own possession is so powerful: it’s rare, it’s real, and it’s in scarce supply. I believe a day is coming when there will be a mad scramble to cover paper silver obligations, triggering a massive divergence—physical silver prices soaring to unprecedented heights while paper silver collapses toward its true value: close to zero. It’ll be like a game of musical chairs with 378 players and only one chair. And if you hold physical silver, congratulations—you’ve already secured your seat.

That kind of relative strength is significant, and I believe it reflects a rotation of capital out of traditional risk assets and into miners—something I noted just a few days ago. Based on my experience and gut instinct, this is a strong signal that miners are poised to soar once the dust settles from the tariff shock.

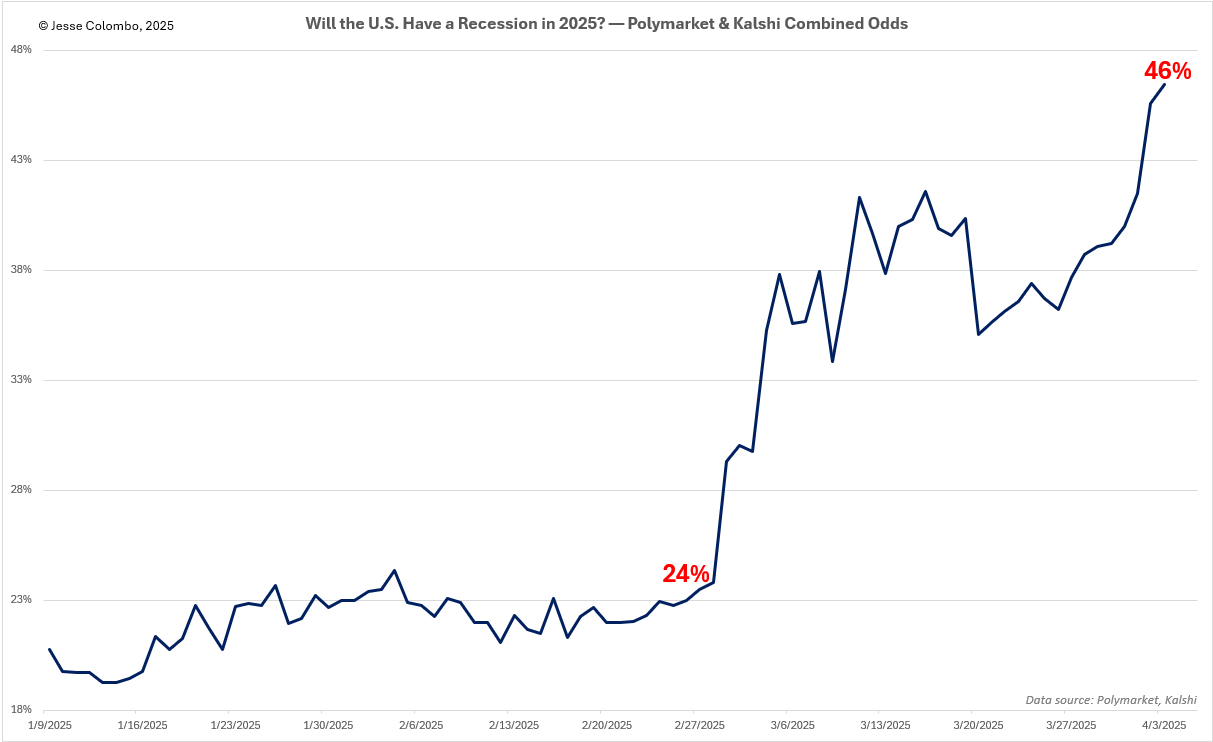

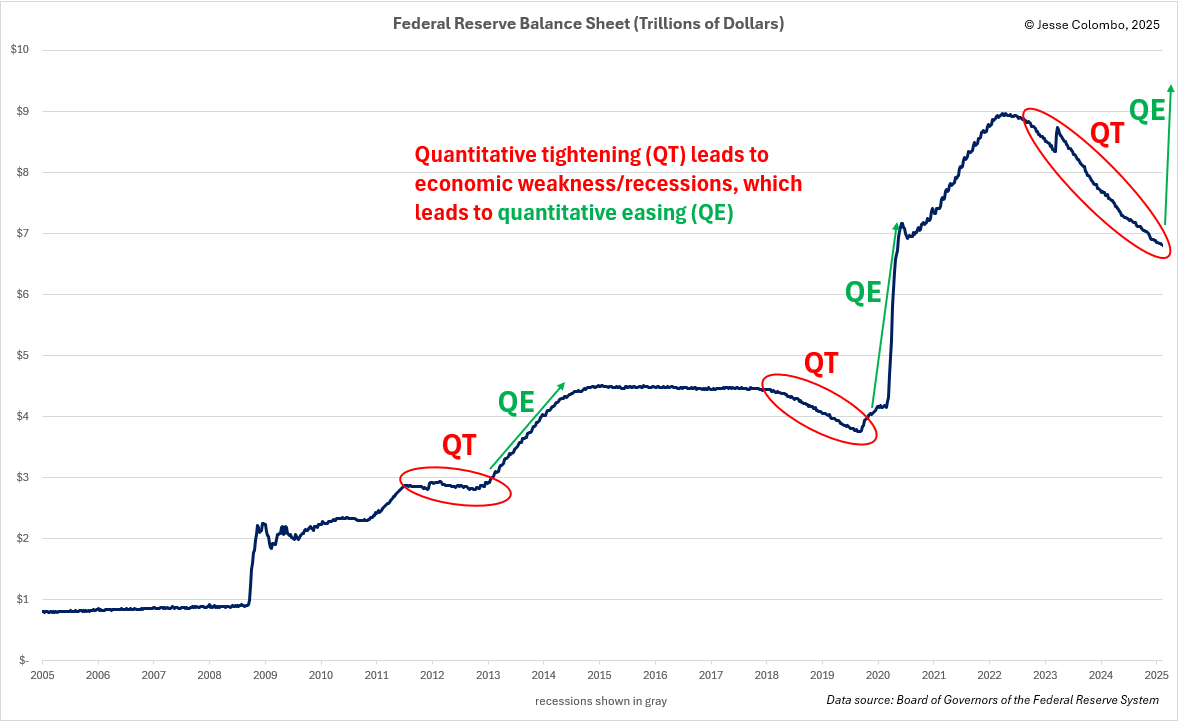

And now that we’re rapidly heading into a recession—as I’ve been warning for months—it’s only a matter of time before the Fed and other central banks step in. That response is what will truly propel gold and silver higher. In fact, we’re already seeing the early signs: the Fed recently announced plans to slow its balance sheet runoff, and speculation is mounting that it may cut rates at its next meeting on May 6–7 to cushion the economy against the tariff shock.

The major catalyst that will send gold and silver into the stratosphere is still ahead: the moment when the Fed is forced to pivot from its current policy of quantitative tightening (QT)—the opposite of stimulus—to quantitative easing (QE), which is essentially digital money printing. This shift is all but inevitable during the coming recession and sharp bear market, following the playbook the Fed has relied on since the U.S. economy became dangerously hooked on stimulus after the 2008 Great Recession.

I also want to sincerely thank you for your patience and for sticking with me during turbulent times like this. At this point, I’ve become one of the most visible and outspoken advocates for precious metals—and on sharp down days like today, I absolutely cringe. And it’s not because I’m the least bit concerned about my own investments, but because I genuinely care about my loyal subscribers and followers who may not yet share the same level of conviction that I do.

I’m extremely confident in the bright future of gold and silver—especially as our financial system and economy, propped up like a giant house of cards, edges ever closer to a major reset. That’s why I continue to speak out and stand firm, and I’m truly grateful to have you on this journey with me. I believe that just a couple of years from now, we’ll be looking back at this awkward phase from much higher levels—with a sense of vindication. But only those who remain rock solid in their conviction and faith will make it through and thrive on the other side.

If you’ve enjoyed this report or have any questions, comments, or thoughts, please give this post a like and share your thoughts in the comments below—I’d love to start a dialogue and hear your perspective.

All investments carry risk, and past performance is not indicative of future results. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher disclaim any liability for financial losses or damages incurred as a result of reliance on the information provided.